Baggy y-fronts and avocado:

An occasional glimpse into the workings of the Scottish Parliament and the Scottish Executive (or comments on anything else that takes my fancy).

30 December 2011

Special pleading

Yeah well, at this time of year, the smug marrieds may irritate us singles. The Independent offers a cri de coeur:

With the number of single-person households increasing rapidly over recent years and projected to continue rising, it is a mystery to me why politicians continue not only to ignore, but to bait this sizeable demographic. While singledom may be a deliberate option for some, for most it's just the card that life has dealt. According to the Office for National Statistics , 29 per cent of households contained just one person in 2010 – that's 7.5 million people living alone. The biggest increase in single person households over the decade 2001-10, was in the age group 45 to 64, a 31 per cent increase, coinciding with an increase in people in this age group who have never married, or are divorced. By 2031, it is expected that 18 per cent of the entire population will be living alone.Maybe we are less worthy beings, but I value my status as a célibataire. But it would be nice not to hear any more about so-called "hard-working families".

Maybe the pollsters can explain to me why all of the political parties think it is worth hacking off this large group to suck up to the smug marrieds (as Bridget Jones would put it). Worse, they imply that it is somehow morally superior to be part of this happy state and those of us who have failed to achieve it are less worthy beings.

24 December 2011

I'll take the fifth

Do I feel guilty about being a baby boomer? Not so much guilt as complacency. The Telegraph reports:

All of which is no damn consolation to today's youngsters seeking to secure a job and a place to live ...

Baby boomers shouldn’t feel guilty about being better-off than younger generations, because people aged over 50 today saved harder and spent less when they were young than is the case today.I confess that I do not recall making prodigious savings in my twenties or thirties. As for spending, I spent what I had to spend; I can still recall my mother's sage advice about the pitfalls of borrowing. So, by and large, we kept out of financial trouble. But the expansion of university education in the 1960s was of enormous benefit to my generation. And the rapid inflation of the 1970s meant that mortgage payments diminished equally rapidly (at least until you had to move house).

That’s the conclusion of analysis of more than 2,000 people by the Chartered Insurance Institute (CII). The study acknowledges that baby boomers – or those born within 20 years of the end of World War II – were fortunate to enjoy easy mortgage availability and decades of house price inflation plus final salary or defined benefit pensions denied to most young adults today.

As a result, about 80pc of the Britain's net personal wealth of £6.7trn or £6,700bn is owned by people aged over 50 while younger folk often have no savings, substantial debts and little hope of becoming homeowners any time soon. The average age of first-time buyers is now 37 or about 10 years later than two decades ago.

All of which is no damn consolation to today's youngsters seeking to secure a job and a place to live ...

23 December 2011

Cutting and running?

President Obama on the BBC website (here) on 14 December:

Mr Obama ... acknowledged it was not perfect, but said they were leaving behind "a sovereign, stable and self-reliant Iraq, with a representative government that was elected by its people".Today's Independent (here):

A wave of orchestrated bombings sent plumes of smoke into the air across Baghdad yesterday, killing at least 72 people and injuring more than 200 in the worst violence for months.

There is a growing sense of a sectarian crisis in Iraq as the Shia Prime Minister Nouri al-Maliki tries to arrest his own Sunni Vice-President on charges of running death squads. The threat of escalating sectarian warfare is deepened by the fear among the Iraqi Shia elite that the Arab Awakening movement is turning into an anti-Shia crusade led by Saudi Arabia and Qatar.

20 December 2011

19 December 2011

Quote of the day

I consider this (from The Independent here) to be alarmist nonsense:

Any sensible expat will put away some euros and some sterling under the bed. The banks may close briefly but the bucket shops offering currency exchange deals will remain open; and credit cards are not going to lose their purchasing power. The peseta will return quite quickly and all will be cheaper (at least in terms of sterling) than before. As long as you don't keep all your savings in a Spanish bank account (where they may suddenly re-appear as pesetas at an unfavourable exchange rate), we'll be OK.

Lady Neville-Jones was asked about a report that the Foreign Office was drawing up plans to evacuate thousands of expatriates, many retired, from Spain in the event of economic meltdown.

"It is very hard to see at the moment how the eurozone in its present form is going to survive. Spain is clearly a vulnerable area," she told Sky News.

"Now if that happens, one of the things that will happen in a crash of that kind is that the banks would close their doors. You would find that there are people there, including our own citizens... who couldn't get money out to live on. I think this is a real contingency that they need to plan against." The Foreign Office was reported to be examining plans to send planes, coaches and ships to Spain and Portugal if people cannot withdraw money, as well as ways of offering loans to stranded Britons.

Any sensible expat will put away some euros and some sterling under the bed. The banks may close briefly but the bucket shops offering currency exchange deals will remain open; and credit cards are not going to lose their purchasing power. The peseta will return quite quickly and all will be cheaper (at least in terms of sterling) than before. As long as you don't keep all your savings in a Spanish bank account (where they may suddenly re-appear as pesetas at an unfavourable exchange rate), we'll be OK.

Sloth

Useful seasonal advice from The Guardian's agony Auntie Hadley (here):

How many days in a row am I allowed to stay in my pyjamas in that period between Christmas and new year?Really?

Maria

There is no time of year I love more than that week between Christmas and new year, and a large part of that is because it is entirely permissible, nay, necessary, even, to stay in in my pyjamas for huge swaths of it. Really, what else is there to do but sit about, eat leftovers and watch Scrooged one more time? And, really, with all of those leftovers one does require an elasticated waistband, and seeing as there is, probably, one already on your nightwear, to bother changing into daytime clothes would be to spit in the face of Santa. And why would you want to spit in the face of Santa, you heartless wench? Stay in your pyjamas. It's what Jesus would have wanted.

16 December 2011

Legerdemain

Is it not amazing how, despite all of our economic problems, the government can suddenly magic up £450 million? The Guardian reports:

David Cameron faced questions over whether he has found enough Whitehall cash to effectively help the 120,000 problem families said to cost nearly £8bn in state support.So what is it that is not being done? I don't suppose that we'll ever know ....

Cameron announced £448m of funding and said he hoped a further £675m would be advanced by local councils over the next three years.

The cash from Whitehall is designed to fund caseworkers to help tackle deep-seated problems faced by "chaotic families", and co-ordinate the often overlapping work of local agencies.

...Cameron was urged to expand the Labour scheme by the Downing Street permanent secretary, Sir Jeremy Heywood. The cash is being drawn from existing budgets held by the Ministry of Justice, the Department for Communities and Local Government (DCLG), the Home Office, the Department for Education and the Department for Work and Pensions.

14 December 2011

Money worries

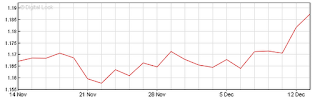

Is now the time to buy your euros for next year's holiday? It has been many months since the £ rode so highly on the exchanges. But maybe postpone the decision, if you think the euro will continue to weaken? Can we hope for 1.25 euros to the £? It's not impossible. On the other hand, perhaps the £ will sink; it's not as if the UK economy is full of vigour.

Awfie difficult ...

Things I would rather not have known, part 36

Is there no place left for romanticism? Must we be always thirled to joyless pragmatism? The Independent reports:

Scientists have discovered why buttercups glow yellow under people's chins – and it has nothing to do with liking butter.

Physicists and plant scientists at Cambridge University discovered that the buttercup's appearance is the result of the interplay between its different layers. The strong yellow reflection is mainly due to the epidermal layer of the petal that reflects yellow light.

It's only shopping ...

So that ended well (or maybe not). Just because the Prime Minister is obsessed with TV personalities does not mean that he ever intends to do something. The Independent reports:

Sir Humphrey wanders into the study at Number 10. "I have Mary Portas on the phone for you Prime Minister." The PM is wading through "her vision for the future of our high streets" and is suddenly feeling very depressed. "Tell her I'm out to lunch," he sighs. "On second thoughts, tell her she is.

...

The Portas report took seven months and is 50 pages long (I read it so you don't have to). Her proposals are these: shops should be better; people should be nicer to each other; we should have more car boot sales; and more bingo nights. (Eh?)And thus another initiative dribbles away into the sand ...

Veering into sociology, the "Queen of Shops" offers: "We no longer value human interaction, socialising or being part of something bigger than ourselves." That we might regain these things through shopping is a depressing thought. The bingo nights could help though.

Hurting but not working

What did the IMF expect? The Guardian reports:

The International Monetary Fund's latest, and fifth, report on Greece reads as a warning that the country's rescue programme has arrived in the last-chance saloon. The numbers have deteriorated every time the IMF has added them up and the latest tally is no exception. Hope that 2011 would witness an "inflection point" in the economy have been abandoned. GDP this year will fall by 6% and 2012 is expected to bring a further contraction of 3%. Worse still, the government's target for cutting the budget deficit has been missed by a mile. The aim was 7.5% but the reality, estimates the IMF, will be 9% – better than last year's 10.5%, but not by much. The report comments dryly that the IMF and euro area support programme "has clearly entered a difficult phase".Their solution? Would you believe, more austerity? Utter insanity ...

13 December 2011

Keeping on keeping on

That didn't take long. All that anguish last Thursday night, the spats, the name-calling, the bladder control. For what? Nothing very much, it appears. City AM reports:

GLOBAL markets were shaken yesterday as fears returned that governments will not manage to save the Eurozone.So we're back to square one. And when S & P downgrades France's AAA rating, we'll be in full crisis mode once again. Will it never end?

The honeymoon period that followed last week’s euro deal proved all too brief, making way yesterday afternoon for a show of bitter disappointment from traders.

Stocks fell sharply, peripheral Eurozone economies saw their bond yields soar towards the “danger zone” again, and the euro dropped as investors fled risky assets once more.

12 December 2011

Frighteningly pedantic

Oh yes, adverbs: pesky little fellows. Avoid if at all possible. The Telegraph reports (apparently):

When I was a young nipper, I was taught that an adverb modifies the verb. But that was just one of those things that teachers say.

Football commentators seem to avoid adverbs as if they had a bad smell. So we get "Mr X played brilliant".

As for me, I can live with a few adverbs. But then I don't have to write submissions to Ms Greening ...

Officials at the Department for Transport have produced a 1,500-word report which details ministers' pet grammatical hates in remarkable detail.The guidance sent to civil servants and MPs lists the particular linguistic errors which infuriate Justine Greening, the Transport Secretary, and her fellow transport ministers.

The five-page document indicates that the member for Putney, Roehampton and Southfields, 42, does not approve of the use of adverbs or abbreviations in official documents.

When I was a young nipper, I was taught that an adverb modifies the verb. But that was just one of those things that teachers say.

Football commentators seem to avoid adverbs as if they had a bad smell. So we get "Mr X played brilliant".

As for me, I can live with a few adverbs. But then I don't have to write submissions to Ms Greening ...

11 December 2011

The explanation

Don't mock! The Telegraph may not be far from the truth:

“So what was it?” demanded Sam. “What made you use the veto? Was is the fear of having to hold a referendum and splitting the fragile Coalition?”Or perhaps not ...

Dave lowered his voice. “Do you remember what happened to Chamberlain when he went weak on Europe?”

“The Second World War?”

“Worse. His long-term rival from the Right of the party took over.”

“Oh, I see,” said Sam. “Boris was right: you have played a blinder.”

Quote of the day

Will Hutton in The Observer (here):

The Friday morning narrative of Cameron resisting European efforts to undermine the City is gradually being replaced by the perception that Cameron's actions had more to do with his political necessity of avoiding the need to secure parliamentary approval for a new treaty.

David Cameron is the best and worst of upper-middle class, home counties England – decent enough but saturated with prejudices he has never cared to challenge. He understands his own party and its instincts, but beyond that his touch is uncertain and his capacity to empathise with others close to non-existent. Doubtless, he thought his demand for Britain to be exempted from any measure on financial services to be reasonable, but he completely underestimated how it would be understood by a eurozone member in an existential fight to defend their currency. His circle is the hedge fund managers who payroll his party, rightwing media executives and the demi-monde of Tory dining clubs, Notting Hill salons and country house weekends, all of whom he knew could be relied to cheer him for his alleged bulldog spirit and Thatcher-like courage in saying No to European "plots".

For him, politics is not about statecraft in the pursuit of a national vision that embraces all the British. It is an enjoyable game to be played for a few years, in which the task is to get his set in and look after them and hand the baton on to the next chap who will do the same.

The Friday morning narrative of Cameron resisting European efforts to undermine the City is gradually being replaced by the perception that Cameron's actions had more to do with his political necessity of avoiding the need to secure parliamentary approval for a new treaty.

10 December 2011

Chisellers?

They're beginning to piss me off. The Independent reports:

Passengers planning to fly Ryanair next summer, beware: charges on Europe's biggest budget airline will soar in 2012. Checked-in bag fees paid in advance increase by two-thirds, while travellers checking in a bag at the airport without booking ahead face a fee of £100 – up 150 per cent.

The airline has divided 2012 into low and high seasons, with the latter stretching across the summer from June to September, as well as Christmas. In peak season, the cost of checking in a single 15kg bag rises from £15 to £25, totalling £200 for a family of four on a return trip. The price for a second bag will be even higher, at £45.OK, I know that the overall cost of a return flight to Malaga remains a good deal, but Ryanair is stretching the patience of us travellers.

09 December 2011

So who won?

Well nobody did. And, in any case, it doesn't really work like that.

Cameron put the kibosh on another EU Treaty (or on an amendment of the existing Treaties), as advocated by Frau Merkel, and thus earned her undying enmity. The City of London has apparently been saved from rule by Brussels, but it is only bankers who will care. And in the longer term, the City cannot expect any favours from Europe.

The members of the eurozone (plus assorted hangers-on) will now establish their separate accord, cracking the whip over debts and deficits. But they will have to do it without the overt assistance of EU institutions such as the Commission and the Court of Justice, while the European Central Bank will or will not fulfil a central role. But as yet, the accord has only been agreed in principle; and there are lots of detail to be hammered out (such as who will conduct the assessment of national budgets).

Meanwhile, the chaos in the markets will no doubt continue ...

Cameron put the kibosh on another EU Treaty (or on an amendment of the existing Treaties), as advocated by Frau Merkel, and thus earned her undying enmity. The City of London has apparently been saved from rule by Brussels, but it is only bankers who will care. And in the longer term, the City cannot expect any favours from Europe.

The members of the eurozone (plus assorted hangers-on) will now establish their separate accord, cracking the whip over debts and deficits. But they will have to do it without the overt assistance of EU institutions such as the Commission and the Court of Justice, while the European Central Bank will or will not fulfil a central role. But as yet, the accord has only been agreed in principle; and there are lots of detail to be hammered out (such as who will conduct the assessment of national budgets).

Meanwhile, the chaos in the markets will no doubt continue ...

08 December 2011

Cameron's true colours

By their words shall ye know them. What is Cameron's main priority going into the summit negotiations? The Telegraph provides the answer, albeit in somewhat cynical tone:

David Cameron has been talking tough on Europe. Addressing the nation via a newspaper article yesterday morning, the Prime Minister made his position stirringly clear. If Angela Merkel and Nicolas Sarkozy do anything that threatens to hurt the City of London, he will defend our island, whatever the cost may be. He will exercise his veto on the beaches. He will exercise his veto on the landing grounds. He will exercise it in the fields and in the streets, he will exercise it in the hills. He will never surrender.

Unless, of course, the question is about the repatriation of social and employment powers, in which case he will surrender, and we shall go on doing on our beaches, landing grounds etc whatever Brussels orders us to do.Note the priority - to defend the City of London. Nothing about manufacturing or other services, or regional policy, social policy or even defence of the constitutional prerogatives of parliament. As long as the City survives to wield its immoral spell on the economy, nothing else really matters.

Well, I didn't vote for him ...

Update: also from The Telegraph (here) which seems to be a bit depressed:

The Prime Minister can engage in as much pre-fight trash talk as he likes. He can square up to the Berlin bruiser Anglea Merkel; look down on that pipsqueak Nicolas Sarkozy. It doesn’t matter.

David Cameron is going to sign that treaty. If it recommends renaming the UK the Greater German province of Albion. If it kicks the Queen out of Buckingham Palace and hands the place over to Herman Van Rompuy. If it requires ministers to attend the next meeting of the Cabinet in Lederhosen. David Cameron will sign.

He has no other option.

The good news

Never mind about the euro. Let us concentrate on important matters, such as brussels sprouts. The Telegraph reports:

It has been an exceptionally good year for the much-maligned vegetable, which has ripened three weeks earlier than usual.Most weigh 25g instead of 20g and are particularly sweet and flavoursome, thanks to the unusually warm winter weather.

Last year Britain suffered a shortage of sprouts due to freezing conditions. But experts said there should not be a repeat this year following perfect growing conditions, including a dry spring, summer rains and the recent mild spell.

So all is well in this best of all possible worlds ...

06 December 2011

The choo-choos won't run

It's a shame. Poor old Alex Neil, Scotland's Infrastructure Minister, sought to make a song and dance about it as the centrepiece of his programme (here):

Poor old Alex. He thought he was going to be the Fat Controller, but now it seems that the levers are further away than ever ...

A proposal to extend the high-speed rail network north of the border was part of a 20-year investment plan announced today by the Scottish Government.Alas, the cup was barely raised to his lips, when the bad news filtered north:

The infrastructure “mega-plan” has ambitious aims to improve roads and rail as well as schools and hospitals across the country over the next two decades.

Infrastructure and Capital Investment Secretary Alex Neil announced the list of strategic projects in Edinburgh today.

The government has announced it is postponing its decision on whether work should start on HS2, the high-speed rail project running from London to Birmingham, Manchester and Leeds.Meanwhile, this guy in The Independent argues convincingly that it may never happen at all:

Justine Greening, the transport secretary, confirmed speculation that the decision on the scheme would be put off until the new year.

Greening, who took up office only two months ago, said that while she had been considering all the issues raised in the HS2 consultation, she needed more time.

The plan to build a high speed rail link in the UK moves even more slowly than a train from London to Cornwall. In what is a bizarrely contorted juxtaposition, all three main parties are theoretically committed to the link and yet it seems increasingly as if the project will not happen. The reasons will be depressingly familiar for those who know the history of ambitious infrastructure projects in Britain. Once more, superficial opportunism, incompetence, fear and ministerial weakness play their destructive roles.

Poor old Alex. He thought he was going to be the Fat Controller, but now it seems that the levers are further away than ever ...

Pseuds' Corner

From The Guardian (here), with regard to the Turner Prize:

Boyce has a more developed sense of the place and engagement of the spectator. His is the more generative and generous art. From the drifts of waxy, geometric paper leaves on the floor, to the dappled lighting; from the wonky litter bin, to the library table as the room's centrepiece; Boyce's room is both impressive and affecting. The beauty lies in its orchestration.Really?

He deserves the prize. I'm haunted by his room, with the way a hanging mobile entwines itself with the library table, like a dangling thought, the room sweeping away into a kind of indoor autumn. His art is a sort of elegy to modernist purity. It feels like a human space and a mental territory. I'd love him to make a permanent room somewhere.

All sweetness and light?

Very pleased for them both, I'm sure. Long life and happiness, and may all their troubles be little ones. The Independent reports:

Admittedly, I'm not entirely clear about the status of "near-automatic" penalties; either they are automatic or they are not. (It's a bit like pregnancy.) Then there is the question of how Greece and Italy (et al) bring their deficits down to acceptable levels; assertion does not automatically (that word again) lead to execution.

Furthermore, if these arrangements need to be embodied in a treaty of the 27 or the 17, how long is it going to take for the proposed treaty to be ratified by the member states and what happens meantime?

Finally, I can't see any solution in the proposals that would address the fundamental issue of the comparative competitiveness of different member states. But, hey, I'm a bit of a pessimist; things are sure to turn out fine. Won't they?

President Nicolas Sarkozy and Chancellor Angela Merkel will ask other EU leaders later this week to approve sweeping ideas for a new, or amended, EU treaty to punish countries that allowed deficits to spin out of control.

Although falling short of the federalist "fiscal union" that Germany had demanded, the plans would impose near-automatic penalties on countries that broke agreed budget and debt limits.

Admittedly, I'm not entirely clear about the status of "near-automatic" penalties; either they are automatic or they are not. (It's a bit like pregnancy.) Then there is the question of how Greece and Italy (et al) bring their deficits down to acceptable levels; assertion does not automatically (that word again) lead to execution.

Furthermore, if these arrangements need to be embodied in a treaty of the 27 or the 17, how long is it going to take for the proposed treaty to be ratified by the member states and what happens meantime?

Finally, I can't see any solution in the proposals that would address the fundamental issue of the comparative competitiveness of different member states. But, hey, I'm a bit of a pessimist; things are sure to turn out fine. Won't they?

04 December 2011

Will they ever learn?

"Probably not" seems to be the answer. The Independent reports:

We may be the majority shareholder in the bank, but it seems no-one - either in Government or in the plethora of regulatory agencies - can bring it to heel.

Note: the value of RBS shares has dwindled to 21.63 pence, compared to about 50 pence when the taxpayer invested all that money in the ailing bank.

Royal Bank of Scotland (RBS) is set to press ahead with an estimated bonus pool of around £500m, despite claims by the group’s finance director that the industry has wasted money on remuneration.

The group, which is 84 per cent owned by the taxpayer, was one of the targets that Sir Mervyn King had in mind when he said last week that banks need to trim bonuses and dividends. The Bank of England governor warned that the “exceptionally threatening environment” caused by the eurozone crisis meant that banks needed to concentrate on hoarding cash.

We may be the majority shareholder in the bank, but it seems no-one - either in Government or in the plethora of regulatory agencies - can bring it to heel.

Note: the value of RBS shares has dwindled to 21.63 pence, compared to about 50 pence when the taxpayer invested all that money in the ailing bank.

02 December 2011

Entschuldigen Sie mir bitte

It's all the fault of the Germans, isn't it? Well maybe, and maybe not. But don't take my word for it, cos I'm biased. When I worked for the European Commission, building the new Europe (or something), my closest office chum was a delightful young lady from Berlin who worked in the office next door. Sonja was an Ostie, and she and I would regularly adjourn to the smoking room to commiserate with each other over the bureaucratic idiocies of the bosses. She still has at least half my Harry Potter books. But she was a pal and provides one of the many great memories of working with European colleagues.

But Merkel is screwing up the system, isn't she? Well we all have our histories and here is something upon which to ruminate. The New Statesman records:

But Merkel is screwing up the system, isn't she? Well we all have our histories and here is something upon which to ruminate. The New Statesman records:

If you wanted to buy a US dollar in 1913, it cost you four German marks; by the end of 1921, it cost you around 200; a year later, 7,000.Governments could no longer afford to pay reparations, since they had to be rendered in gold. Things got really bad in 1923, when France invaded Germany's most prosperous industrial area, the Ruhr, to extract the reparations that the Germans had failed to deliver. Strikes ensued, the German economy ground to a halt and inflation spiralled out of control.So have a little sympathy.

By July 1923, a dollar cost 353,000 marks; by August, nearly five million; by September, nearly a hundred million; by December, 4.2 trillion - or four followed by a two and eleven zeros. People were collecting their wages in wheelbarrows filled with million-mark notes and rushing to the shops before the price spiralled upwards again and goods were out of their reach. You might sit down in a café for a cup of coffee and find that its price had doubled by the time you got up.

The political system began to disintegrate. Hitler staged his beer-hall putsch. There was a communist uprising in Hamburg and the threat of one in the east. Separatists emerged in the Rhineland. The chaos was only ended when the Americans were persuaded to lend money for a currency reform.

The hyperinflation did not destroy the Weimar Republic. What did for it was the ensuing depression, when the Wall Street crash led the US banks to withdraw the loans that had underpinned the modest recovery of the middle Weimar years. Mass unemployment had the jobless rushing to vote for the communists, terrifying the middle classes, already disoriented by inflation, into supporting the Nazis.

S & M economics

Much (probably wayward) talk of "discipline". What is it that Merkel and Sarkozy want? And is it the same thing? The Guardian eurozone blog exposes the difference - at least I think it's a difference.

There are different interpretations. Merkel wants the European commission to have a veto over countries' tax and budget plans, whereas the French want national parliaments to be involved, as the budget minister Valérie Pécresse spelled out yesterday.

Pécresse declared after a cabinet meeting that France wanted "more budgetary discipline, but a budgetary discipline exercised by the states, with a real participation by national parliaments" .

So plenty of hurdles to overcome. Including in Germany - as Merkel pointed out in her speech, "the German constitution does not permit devolving budget control to a European institution".

She said her vision was that the European commission and the European courts must have a bigger role "without the German parliament losing budget control". The big question, though, is how is fiscal union credible if parliaments can veto the demands of the central authorities?

Difficult to fudge this. Merkel and Sarkozy appear to want more central control, but not at the expense of national parliaments or, at least, of their national parliaments. Which means, I suppose, a very severe limit on the control of central authorities. Which kinda invalidates the whole shooting match (unless of course it is only the less respectable national parliaments - yes our Mediterranean chums again - that are expected to submit to the will of Brussels and Frankfurt) ...

Inconvenient targets

What does the Cameron administration do when it fails to meet targets? Does it try harder in an effort to succeed? No, it changes the targets. Two examples in this morning's Guardian; here and here:

The government is planning to review official targets for reducing poverty, arguing that simply comparing relative incomes leads to perverse incentives and does little to promote better life chances.And

The move was signalled by the work and pensions secretary, Iain Duncan Smith, and David Cameron in the week that the government was forced to admit that its autumn statement will mean another 100,000 children brought into child poverty under the measure enshrined in law by the Labour government.

The Department of Energy and Climate Change commissioned an independent review of fuel poverty after last autumn's comprehensive spending review. Its interim findings, published earlier this month, proposed changing the definition of fuel poverty. If adopted, the proposals would halve the numbers of households defined as being in fuel poverty.Coming soon: a review of the definition of unemployment (as far too many people are classified as unemployed) and a review of the definition of literacy (as far too many kids are unable to write when they leave school). As for measuring inflation, they've been messing about with the basket of commodities for years ...

01 December 2011

It's the same the whole world over ...

It wasn't all brickbats, you know. Slasher Osborne found room to confer the occasional goodie, such as this one, reported in The Guardian:

"We're all in this together" sounds more hollow the more you tap it. Back in March, the chancellor George Osborne announced that passengers on private jets would have to pay the same air passenger duty (APD) the rest of us do. "The wealthiest should not escape the tax the ordinary holidaymaker has to pay," trumpeted Osborne through a rolled-up copy of the Socialist Worker. Except that now Osborne has announced this week that the so-called "Learjet tax", expected to start next year, won't kick in until 2013.The excuse may seem a bit thin, but isn't it comforting to know that the Chancellor keeeps close to his heart the interests of those who can afford to hire a private plane?

Why the delay? A Treasury spokesperson says: "We had a consultation and one of the things that came out of it was there wasn't enough time for the industry to make the transition." According to the Treasury, the predicted revenue from the estimated 80,000 private flights is just £5m a year, and as Adam Twidell, CEO of PrivateFly, a booking network for private planes, points out, it will be difficult to collect APD from thousands of small jet companies and individuals.

30 November 2011

Scab?

It's a bit lame. The Scotsman reports:

Finance Secretary John Swinney said today that it was his duty to cross a picket line and lead a Holyrood debate on public sector pensions.Some might argue that it was his duty to abstain from crossing a picket line. Well, at least we now know where the SNP stands - and it's not on the side of the workers.

Mr Swinney will be at the Scottish Parliament, despite calls from Labour and the Green Party for politicians to take to the streets with striking public sector employees.

The SNP administration refused to clear the parliamentary timetable and will debate what Mr Swinney called a UK Government “cash-grab” on pensions.

While Labour and the Greens will steer clear, Tory and Liberal Democrat MSPs are expected to take part in the debate.

Not the muppets, apparently

You have to understand that the leading politicians in the coalition are not very sophisticated. The Guardian takes them to task:

Memo to the coalition front bench: JLS called, and they want their colour-coded look back.What? Me? Since I retired, I don't wear ties, except at funerals (black) and weddings (light grey). And no, I've no idea who JLS might be ...

From their early days on The X Factor, the boyband developed a formula whereby each member wore a similar outfit in different colours. This worked brilliantly on a TV talent show, lending them coherence and individuality. But is it too much to expect a little more sophistication at the House of Commons than one does when watching a Saturday night talent show? Apparently so.

The quartet of block-coloured ties modelled by Osborne, Cameron, Alexander and Clegg for the autumn statement was an eyesore. Cobalt blue, purple, pink and blush: frankly, the Muppets use a more nuanced palette.

Quote of the day

Just a thought from The Independent (here):

... one can't help but notice that the £975m cost of next year's fuel duty concessions is, according to the Treasury's balance sheet, identical to the gains being made from cancelling child tax credit increases. The poorest families are, in other words, subsidising all drivers.Think about that the next time you fill your tank.

29 November 2011

Fiddling while the country burns

I appreciate that you are hanging on for my pearls of wisdom anent the Autumn Statement. Notwithstanding the above assessment, I will ponder overnight and let you know if anything emerges by morning.

Meanwhile the eurozone ministers have begun their meeting, anxious as ever to avoid committing themselves to a decision, which may have more significance for the UK economy than Boy George's witterings ...

Meanwhile the eurozone ministers have begun their meeting, anxious as ever to avoid committing themselves to a decision, which may have more significance for the UK economy than Boy George's witterings ...

28 November 2011

27 November 2011

Are we supposed to be impressed?

Some advance notice on Tuesday's announcement (here):

New Year price rises for motorists and train passengers are to be curbed by George Osborne this week as the Chancellor strains to avoid Britain reversing into recession. Tuesday's Autumn Statement will include high-profile pledges to limit rail fare increases to about 6 per cent instead of 8 per cent, while the planned 3p rise in fuel duty will also be delayed, possibly until April.Big deal! It may be better than a poke in the eye with a sharp stick. But not much better.

Quote of the day

Ed "Crybaby" Balls, in The Independent (here):

Mr Balls, who will face the Chancellor for a Budget-related statement in the Commons for the first time, said: "This isn't about trade union leaders – this is about dinner ladies and teaching assistants and people in local government who feel as though they've worked hard for 30 years and suddenly are being stung at a late stage in their career – predominantly low-paid women. I have huge sympathy with them.Maybe he's not such a bad guy after all ...

"The unions still need to give some ground, but I think what the Government is trying to impose is both unfair and very risky.

"I don't think anybody wants a strike next Wednesday... But, despite the best efforts of civil servants and negotiators and maybe some ministers, it's pretty clear that, at the most senior level, the Government's been determined to have a confrontation."

24 November 2011

Evidence-based policy-making?

Why are they doing this? There is no evidence that it will contribute to increased employment or to the growth agenda. The Independent reports:

It is the most radical shake-up of employment law for decades – but even the Business Secretary admits there is no evidence it will boost the economy. The controversial Downing Street plan to allow employers to fire three million workers "at will" was kept alive by Vince Cable yesterday, albeit with no ringing endorsement from the Liberal Democrat cabinet minister.Is it just to keep the Tory cronies in the City happy? Victorian values indeed ...

23 November 2011

Poor old Silvio

Hey, I know you guys get a bit bored with all this stuff about Euroland, but it's important (I think).

If you want to keep up with the details, you can read about it here. But things are not going well. Even the mighty German economy may not be doing as well as Frau Merkel und Freunden think, if the result of their sale of bonds this morning is a sign. And the yields on bonds for the Club Med are still much higher than comfortable. (I can't really explain why bond yields are so important these days; when I was a lad, it was the balance of payments that we worried about. Fashion, I suppose.)

Meanwhile President Barroso's plans for "stability bonds" (nice name, Jose!) appear to be still-born, as Angie has delivered the black spot. Oh, and Hungary is in deep financial doo-doo, even though it's not in the eurozone.

That apart, everybody is happy (well more or less), with the exception of Signor Bunga Bunga who may be regretting his relationship with Ruby Heart-Stealer ...

If you want to keep up with the details, you can read about it here. But things are not going well. Even the mighty German economy may not be doing as well as Frau Merkel und Freunden think, if the result of their sale of bonds this morning is a sign. And the yields on bonds for the Club Med are still much higher than comfortable. (I can't really explain why bond yields are so important these days; when I was a lad, it was the balance of payments that we worried about. Fashion, I suppose.)

Meanwhile President Barroso's plans for "stability bonds" (nice name, Jose!) appear to be still-born, as Angie has delivered the black spot. Oh, and Hungary is in deep financial doo-doo, even though it's not in the eurozone.

That apart, everybody is happy (well more or less), with the exception of Signor Bunga Bunga who may be regretting his relationship with Ruby Heart-Stealer ...

22 November 2011

Quote of the day

The CBI big cheese (from The Independent here):

And this guy thinks he can preach to the rest of us about a sense of entitlement?

The president of the CBI has warned that Britons need to shed their "sense of entitlement" if the economy is to recover. Speaking at the employer body's annual conference in London, Sir Roger Carr argued that people in the UK are experiencing a "cultural cold shower" thanks to rising global competition.

"Most of us... have grown up in the West with a sense of entitlement – to jobs, opportunity, wealth," he said. "What's happening all around us is a cultural cold shower, a move from entitlement, a recognition that things have changed, nothing is by right: we have to earn our place in a vigorously competitive world as individuals and as nations.""Sense of entitlement" is it? I'll give him "sense of entitlement". This is the man who was chairman of Cadbury up until it was sold to Kraft. But he found himself an even softer billet as chairman of Centrica (formerly British Gas), the company which thinks it is "entitled" to hike up fuel bills as often and as stonkingly as it chooses. And he is the chief of the CBI fatcats, whose "sense of entitlement" enables them to pay themselves so well regardless of the performance of their companies.

And this guy thinks he can preach to the rest of us about a sense of entitlement?

21 November 2011

Making the same mistakes

Is this not where we went wrong last time around? The Independent reports:

Does anyone in government ever look at past history? It is not so long ago that negative equity made its appearance ...

Under plans to be unveiled by David Cameron and Nick Clegg today, the Government will underwrite a proportion of mortgages for newly built homes – the first time any such scheme has been attempted in the UK.There's more:

By taking on some of the risk of lending, the Government hopes to bring down deposits of up to 20 per cent for first-time buyers to as little as 5 per cent, and to kick-start demand for homes.

The Government will underwrite a small percentage of each loan on newly built property. Banks are typically demanding a deposit of 20 per cent on loans to first-time buyers and, by guaranteeing a portion of the loan, the Government will in effect be shifting that "loan-to-value" ratio so that the borrower needs a smaller deposit – possibly as little as 5 per cent. That, it hopes, will lead to more demand and provide a boost to the construction industry in terms of sales and employment.Don't get me wrong; I'm all in favour of helping first-time buyers. But the value of this scheme seems doubtful. Why persuade such buyers to take on a debt which is so close to the market value of the associated debt? What happens when the mortgage interest rate rises and/or the value of the house declines?

The state would not be first in line in the event of a default. Instead, homeowners would still lose their deposits before the Government suffered losses, which would be shared with the lender.

Does anyone in government ever look at past history? It is not so long ago that negative equity made its appearance ...

The wrong kind of weather

When in doubt, blame the weather. The Guardian reports:

Retailers knew they were in trouble when a swallow was spotted this month at the RSPB bird reserve at Saltholme on Teesside.And when the cold snap eventually arrives, that will no doubt also put off potential shoppers. What we need is more of that Goldilocks weather, not too warm and not too cold. (Unfortunately, British weather - like the British economy - is not what one might describe as reliable.)

This freak harbinger of spring was bad news for store bosses whose shops are packed to the gunnels with faux fur coats, cashmere jumpers and fake snow. On Sunday the topsy-turvy weather was being blamed for a sharp fall in visitors to UK shopping centres and high streets over the last three months; places such as the West Midlands and Scotland recorded declines of 10.4% and 9%, respectively.

18 November 2011

It's not going to keep you warm

Would you pay £5,000 for this outfit? Well, somebody did. The Independent reports:

Kylie Minogue's underwear has sold for £5,000 at auction.

The red silk La Perla lingerie set - comprising of a bustier with lace trim and silk and tulle body - quickly surpassed the predicted £2,000 to £4,000 bid when it went under the hammer at Christie's auction house in London on Tuesday (15.11.11) along with a signed copy of the Kylie 2012 Official Calendar.

I suppose that it would have been washed and ironed. (Or does that reduce the attraction?)

Northern Rocky

Would you really trust this guy with your savings? Thought not; nor would I ...

(Interesting to note that Virgin Money is offering a paltry 0.1% interest on its cash ISA.)

16 November 2011

Deep thought

While I'm on the subject of defence, I note that we are running short of attack submarines. PA reports:

The Royal Navy faces a shortage of attack submarines as a result of decisions taken in the Government's Strategic Defence and Security Review, the Whitehall spending watchdog has warned.Now, call me a simpleton if you must, but the last time I can recall a submarine doing anything useful was during the Falklands conflict, almost thirty years ago. In the present day, I wonder which country are our attack submarines intended to attack? From whom are they defending us? (France is not the correct answer.) Oh, and our subs do seem to keep bumping into things.

The National Audit Office said delays to the new Astute class would leave the Navy without sufficient submarines for operations over part of the next decade while adding £200 million to the cost of the programme.

I appreciate that we have to give the Royal Navy toys to play with, and I accept that they might possibly come in useful some day. But the government should perhaps think about its priorities for public spending ...

Who's in charge of the asylum?

What do the US Marines know that we don't? The Guardian reports:

Britain's entire fleet of Harrier jump jets, the veteran plane scrapped in last year's defence review, has been saved - by the American military.

All 74 of the planes are to fly again for the US marines in a deal that is expected to be closed within a week.

The Ministry of Defence said last night that negotiations were in their final stages. Reports in the US suggested the Marines were already preparing for their arrival.

Is it just that the Ministry of Defence is supremely incompetent? As they say, tell it to the marines.

Neologisms

If I tell you that I am a suave, sophisticated, handsome and intelligent chap, you might think I was telling fibs. But I'm not; it's just that this is 'management information', a newly discovered nice-sounding euphemism deployed in government circles. The Independent explains all:

Home Office ministers faced a fresh crisis last night after being rebuked for manipulating drug-seizure figures in an apparent attempt to generate good publicity for the embattled Border Agency. Sir Michael Scholar, the chairman of the UK Statistics Authority, condemned the department for a "highly selective" briefing to journalists which claimed that the amount of heroin and cocaine detected at ports and airports had soared – just days before properly audited figures showed seizures had fallen.That makes it all right, you see. Only a simpleton would believe that management information had to be true or correct.

...

A [UKBA]spokesman said: "The figures used to highlight the UK Border Agency's work in tackling the harm caused to communities by cocaine and heroin were clearly labelled management information.

15 November 2011

Music of the week

More gas-oven rock, I'm afraid. Why? Because we're not a happy blogger - generically, I mean, rather than at this precise instant. Anyway, the music is cool.

14 November 2011

If voting changed anything, they'd abolish it

Well they have, at least for Greece and Italy.

Ms Ashley sets out the scenario:

Impossible? Absurd? Not if you're Greek or Italian. So is technocratic dictatorship an answer, even in the short term?

We'll see ...

Ms Ashley sets out the scenario:

David Cameron and George Osborne have resigned. They did their best, but were unable to carry support, even in the Tory party, for the devastating attacks on pensions and living standards the markets demand. To prevent a British default, Reginald Pinstripe-Grey, formerly chief economist of Megabank in New York, is to be installed in the Lords as acting prime minister, leading a Government of Unity and Patriotism.

In London, representatives from the EU and German "advisers" will sit alongside the truncated cabinet. British MPs have been warned that any attempt to resist the extreme austerity measures by parliamentary vote will result in the final collapse of the British economy, and anarchy. No elections will be held in the meantime.

Impossible? Absurd? Not if you're Greek or Italian. So is technocratic dictatorship an answer, even in the short term?

We'll see ...

Snow-white and the seven dwarves

Oh yeah, I drew your attention to them here.

But now, because of this magnificent flight of fancy, I will never again be able to take them seriously ...

But now, because of this magnificent flight of fancy, I will never again be able to take them seriously ...

12 November 2011

All mouth and no trousers

Think he'll actually do anything? No, nor do I. But let us record what he said, according to The Independent:

Oh yeah? Prove it "absolutely"!

Reports that RBS is planning to hand out as much as half a billion pounds, despite falling profits, have sparked widespread anger, following the £950 million the bank paid in bonuses last year.The bank's pay pool, from which salaries and bonuses are paid, is understood to stand at £1.99 billion - only marginally lower than the £2.14 billion figure from 2010 and enough to provide bonuses of around £500 million.But Mr Cameron today told BBC Radio 2's Jeremy Vine Show: "Let's be clear, that is not the agreed figure."The British Government is a major shareholder in RBS. That is a proposal I have read about in the newspapers, that's not agreed."We have a very big influence over it. We can stop the £500 million, absolutely."

Oh yeah? Prove it "absolutely"!

St Theresa messes up

I'm not usually one for jokes, but here is the Theresa May joke of the week:

The estimable Lucy in The Guardian explains:

Knock, knock

Come in.

The estimable Lucy in The Guardian explains:

Is there anything more heartwarming than two state apparatchiks engaged in a giant game of he-said-she-said? Home secretary Theresa May says that she said Brodie Clark, head of the UK Border Control Agency, could run a pilot scheme to try letting in a few more people, just some nice ones that he liked the look of, just when it was really busy an' that, but that then he just started letting, like, LOADS of people in without even TELLING her and how was that her fault, Mr Cameron, sir? But Brodie says he, like, totally didn't do that and now he's, like, all in her face saying she shouldn't have said it and that she shouldn't have suspended him when he didn't do nothing. And now he's, like, jacked the job in and Yvette Cooper's all "T'resa was only saying let them in because she wouldn't pay for enough people to stop them anyway AND she knows it! She's such a liar, Mr Miliband, isn't she?!"

I foresee tears before bedtime, I do. Ours, of course. Not theirs. Never theirs.

09 November 2011

The gnomes of Brussels

Ah yes, there is a secret cabal in charge. The Guardian reports:

This would more worrying, were it not for the fact of the Group's manifest incompetence. At every stage in the euro crisis they have been reacting to events, mostly unsuccessfully. Last week's G20 (and the preceding EU summit) simply confirmed that the Group bungle everything they touch.

Here's how things work. The real decisions in Europe are now taken by the Frankfurt Group, an unelected cabal made of up eight people: Lagarde; Merkel; Sarkozy; Mario Draghi, the new president of the ECB; José Manuel Barroso, the president of the European Commission; Jean-Claude Juncker, chairman of the Eurogroup; Herman van Rompuy, the president of the European Council; and Olli Rehn, Europe's economic and monetary affairs commissioner.

This group, which is accountable to no one, calls the shots in Europe. The cabal decides whether Greece should be allowed to hold a referendum and if and when Athens should get the next tranche of its bailout cash. What matters to this group is what the financial markets think not what voters might want. To the extent that governments had any power, it has been removed and placed in the hands of the European Commission, the European Central Bank and the IMF.

This would more worrying, were it not for the fact of the Group's manifest incompetence. At every stage in the euro crisis they have been reacting to events, mostly unsuccessfully. Last week's G20 (and the preceding EU summit) simply confirmed that the Group bungle everything they touch.

04 November 2011

Under the thumb?

Brussels hegemony extends its tentacles. According to Reuters:

Italy, under fierce pressure from financial markets and European peers, has agreed to have the IMF and the EU monitor its progress with long delayed reforms of pensions, labor markets and privatization, senior EU sources said on Friday. Prime Minister Silvio Berlusconi, his government close to collapse after more loyalists defected on Thursday, agreed to the step in late-night talks with euro zone leaders and U.S. President Barack Obama on the sidelines of a G20 summit in Cannes, France.Thus do the gauleiters of the Commission impose their will on a once independent nation. Where will it stop?

A minor miracle of modern technology

Apparently (though I'm not sure I believe it), you may now access this blog via one of those fancy mobile phones.

As I don't possess even a simple mobile phone (spawn of the devil, y'know), I am unable to verify this.

If anyone out there has the means and the inclination to find out, do let me know in the comments section.

As I don't possess even a simple mobile phone (spawn of the devil, y'know), I am unable to verify this.

If anyone out there has the means and the inclination to find out, do let me know in the comments section.

Bottom of the barrel

The Independent reports:

(Sorry, couldn't resist it)

Andy Murray's quest to win a fourth successive title ended in disappointment yesterday when he withdrew with an injury shortly before his scheduled first-round match against Robin Haase in Basle. Having strained his right gluteal muscle, the 24-year-old Scot must now try to regain fitness in time for the Paris Masters, which begins on Monday.It's a pain in the arse!

(Sorry, couldn't resist it)

Whistling in the dark

I am striving, somewhat half-heartedly, to keep up with the soap operas taking place in Cannes and Athens. But this statement (quoted in The Independent) has to be the most fatuous of the day:

In London, Mark Hoban, the Financial Secretary to the Treasury, referred to the single currency "breaking up" – and told MPs that the Government had contingency plans in place to deal with the potential collapse of the euro.

He said: "This Government is well prepared for any eventuality."

And the band played believe it if you like ...

03 November 2011

Broccoli's not for me

They're at it again. The Independent reports:

No thanks. If I have to prolong my life, thus adding to the burden of the NHS, I'd prefer not to bother if it means forgoing the occasional chocolate eclair or avoiding salt on my fish supper.

If the Scots, Irish and Welsh ate like the English it would save 4,000 lives a year.

Researchers made the calculation after studying the average diets in each country and the death rates from cancer, heart disease and stroke. They call for a fat tax, combined with subsidies for fruit and vegetables, to change eating habits and reduce deaths in the UK.

...

"We believe that taxes on salt and saturated fat, coupled with subsidies for fruit and vegetables, should be considered," Dr Scarborough said.

No thanks. If I have to prolong my life, thus adding to the burden of the NHS, I'd prefer not to bother if it means forgoing the occasional chocolate eclair or avoiding salt on my fish supper.

Not really helping

Imagine the reaction of the Scottish electorate if Mr Cameron and Mr Miliband began laying down the law about how we should vote in the referendum on Scottish independence and promising dire consequences if we failed to do their bidding.

Then think of the Greeks and how they are likely to react to this interference in their political future:

(From City AM)

Then think of the Greeks and how they are likely to react to this interference in their political future:

GREECE was given an ultimatum last night: vote for austerity or leave the euro.

The country will now go to the polls in a referendum on 4 December, but it is not yet clear whether it will vote on its latest €100bn bailout package and the attached conditions, or on membership of the euro itself.

Last night, it was clear that Germany and France would prefer a vote on the latter.In a decisive shift in tone, German Chancellor Angela Merkel said that Greece must make its own decision on membership, but that her priority is now to defend the single currency “with or without Greece”.

(From City AM)

02 November 2011

Music of the week

A wee story for you. Back in 2003, in the run-up to the invasion of Iraq, the lead singer of a Texas country and western group, the Dixie Chicks, had a moment of political controversy at a concert in London. Miss Maines stated: "we don't want this war, this violence, and we're ashamed that the President of the United States [George W. Bush] is from Texas". So far, so commendable, you might think. I do. But the wingnuts of the American Right went bananas. There followed public destruction of their CDs, banning from various country radio stations and even death threats. This song is the girls' eventual response. I think it's a good pop song - see what you think:

Not good enough

I can sympathise when an employee is overworking and gets a bit tired. The Guardian explains:

On the other hand, this guy received a rather nice signing on fee:

As a taxpayer, a shareholder and an account-holder, I think that I am entitled to ask why the bank hired - at vast expense - a guy who can't hack it?

Lloyds Banking Group has been thrown into chaos by the sudden illness of new chief executive António Horta-Osório.

The bailed out bank recruited the Portuguese-born banker with much fanfare at the start of the year but he has asked the board for a temporary leave of absence.

The 47-year-old is thought to be suffering from fatigue due to overwork. He is expected back before the end of the year.

On the other hand, this guy received a rather nice signing on fee:

Taxpayer-backed Lloyds Banking Group is expected to face tough questions at its annual meeting today over a multimillion-pound pay deal for its new chief executive.

Shareholder groups the Association of British Insurers (ABI) and Pirc have both raised concerns about António Horta-Osório's signing-on deal, worth up to £13.4m, to their members.

As a taxpayer, a shareholder and an account-holder, I think that I am entitled to ask why the bank hired - at vast expense - a guy who can't hack it?

The money shot

When the euro-nag is lying prostrate on the ground, snorting its last breaths in agony, there comes a time to stop flogging it. But the Germans and the French appear to believe that, if the Mediterranean passengers in the back of the cart would only tidy themselves up a bit, the poor bloody horse will prick up its ears and resume its place in the traces. Well, it's not going to happen.

The fact that last week's grand deal is rapidly disintegrating is neither here nor there. More pertinent is the absence of any idea how to approach the differing levels of economic performance within euroland, other than continued bouts of austerity for our southern cousins. And each time, austerity reduces their capacity to grow. Greece is in a vicious spiral where each new round of public expenditure cuts makes it ever more difficult to repay its debts; and Spain, Portugal and Italy are being prescribed the same medecine. There is no sensible future in this course.

So now is the time to let those weary passengers jump off the cart and revert to their original currencies. To be sure, it would be a painful process. The European banks would take a severe pounding, to the extent that some of them would have to be nationalised. The inevitable devaluation of the drachma, the peseta and so on would result in a significant blip in inflation for those countries concerned. But as their exports became cheaper and their tourism industries revived, they would at least have a chance of restoring their economies to some form of equilibrium.

So let them go. Locking them into an economic straitjacket designed for and dominated by Germany will only come to grief.

The fact that last week's grand deal is rapidly disintegrating is neither here nor there. More pertinent is the absence of any idea how to approach the differing levels of economic performance within euroland, other than continued bouts of austerity for our southern cousins. And each time, austerity reduces their capacity to grow. Greece is in a vicious spiral where each new round of public expenditure cuts makes it ever more difficult to repay its debts; and Spain, Portugal and Italy are being prescribed the same medecine. There is no sensible future in this course.

So now is the time to let those weary passengers jump off the cart and revert to their original currencies. To be sure, it would be a painful process. The European banks would take a severe pounding, to the extent that some of them would have to be nationalised. The inevitable devaluation of the drachma, the peseta and so on would result in a significant blip in inflation for those countries concerned. But as their exports became cheaper and their tourism industries revived, they would at least have a chance of restoring their economies to some form of equilibrium.

So let them go. Locking them into an economic straitjacket designed for and dominated by Germany will only come to grief.

01 November 2011

Money for old rope

I don't know why there should be such a fuss about Mr Hansen's weekly pay packet of 40,000 smackers.

I admit that his bons mots may be occasionally lacking in insight, but he wears nice shirts and is slightly more articulate than his colleague Mr Shearer. Not that that necessarily counts for much, given the banality of the latter's contributions.

I admit that his bons mots may be occasionally lacking in insight, but he wears nice shirts and is slightly more articulate than his colleague Mr Shearer. Not that that necessarily counts for much, given the banality of the latter's contributions.

Putting the cat among the pigeons

Well, that's torn it! The Telegraph puts it politely:

Eurozone policymakers will view with horror George Papandreou's decision to hold a referendum on the Greek bailout package. Less than a week after agreeing a "comprehensive" deal to resolve Europe's sovereign debt crisis, the whole thing already seems to be coming apart at the seams. The Greek prime minister's commitment to a plebiscite introduces a further element of extreme uncertainty.Merkel and Sarkozy must be jumping up and down with rage. Even if the Greeks approve the deal (which seems unlikely), Mr Papandreou can say goodbye to any future favours from the EU. So don't come back looking for any more bail-outs. Indeed, the Greeks might well be expelled from the Eurozone, regardless of the result of the referendum.

29 October 2011

Oh dear

The first signs of unravelling:

Here:

Here:

Eurozone leaders were left sweating last night after China played down expectations that it would quickly make a much-needed cash injection to the EU bailout fund.And here:

Fear made a swift return to the eurozone yesterday as Italy faced record borrowing costs in its first attempt to tap the markets since European leaders came up with new plans to rein in the sovereign debt crisis.

Quote of the day

Yes, it's that great egalitarian, Mr Cameron:

"Put simply, if the Duke and Duchess of Cambridge were to have a little girl [as their first child], that girl would one day be our queen," Cameron said. "The idea that a younger son should become monarch instead of an elder daughter simply because he is a man, or that a future monarch can marry someone of any faith except a Catholic – this way of thinking is at odds with the modern countries that we have become."But what kind of modern country continues to insist that the monarch be a member of the Church of England (regardless of whether he or she has married a Catholic or a muslim or a hindu)?

The rich man in his castle, the poor man at his gate

What a strange thing to do. The Guardian reports:

So workers in the voluntary sector are to be fobbed off with what are clearly lower grade gongs. If Mr Cameron wants to honour more workers in the voluntary sector, why not give them more MBEs? Or is the Big Society to be stratified by class and seniority?

The British Empire Medal (BEM), described as the working-class gong, is to be revived as David Cameron reverses one of John Major's signature reforms that was designed to create a classless society.The prime minister, who is consulting the Queen on the change, hopes the revived medal will be awarded to people involved in voluntary work.Downing Street, which has been looking for ways to revive the prime minister's big society initiative, believes that people involved in the voluntary sector are often overlooked in the current honours system. The prime minister hopes that people who are not considered senior enough to receive an MBE or OBE will be able to receive a BEM.

So workers in the voluntary sector are to be fobbed off with what are clearly lower grade gongs. If Mr Cameron wants to honour more workers in the voluntary sector, why not give them more MBEs? Or is the Big Society to be stratified by class and seniority?

28 October 2011

We're all in this together (part 31)

Now calm down, tell me what's upset you.

It's those greedy fatcats. It's just been announced that the average FTSE-100 executive director plundered a 49% increase in their remuneration last year.

And you think it's disgraceful?

Damn right. We peasants are struggling to keep up with inflation, while they are positively rolling in it.

I recognise that the uplift in the remuneration of the boss classes does not necessarily reflect company performance, but you must take account of the need to recruit and retain the best possible talent.

They never say that about the workers. With us, it's that you need to work harder and longer or lose your job.

That is because you proles are instantly replaceable, preferably by machines.

But how can you justify such massive increases for the bloated plutocrats?

Pay peanuts, you get monkeys. Now return to your miserable hovel and starving children and allow me to peruse the Porsche catalogue in peace.

It's those greedy fatcats. It's just been announced that the average FTSE-100 executive director plundered a 49% increase in their remuneration last year.

And you think it's disgraceful?

Damn right. We peasants are struggling to keep up with inflation, while they are positively rolling in it.

I recognise that the uplift in the remuneration of the boss classes does not necessarily reflect company performance, but you must take account of the need to recruit and retain the best possible talent.

They never say that about the workers. With us, it's that you need to work harder and longer or lose your job.

That is because you proles are instantly replaceable, preferably by machines.

But how can you justify such massive increases for the bloated plutocrats?

Pay peanuts, you get monkeys. Now return to your miserable hovel and starving children and allow me to peruse the Porsche catalogue in peace.

27 October 2011

Just a thought ...

So the FTSE-100 opens 95 points above last night's close.

Would it be cynical of me to wonder if it will come back down again in a day or two when the Grand Euro-Deal unravels (as it surely must)?

Would it be cynical of me to wonder if it will come back down again in a day or two when the Grand Euro-Deal unravels (as it surely must)?

What would St Paul have said?

It must be a day for editorials. I approved of this one in The Independent:

It is not unreasonable for the protesters, and indeed the wider public, to ask whose side the church is on. In initially extending a welcome to the occupation, then withdrawing it, the Dean and Chapter at St Paul's resemble nothing more than a disgruntled householder or inconvenienced road-user. Nor is it the fault of the cathedral, or the Anglican church, that "health and safety" has become synonymous with a culture of excessive caution and a cipher, for many, of Britain's ills. But to cite "health and safety" as a reason for closing a mighty and much-loved building seems at once petty and an overreaction.The protesters were not inside the cathedral; they were, and are, camped outside. Their tents do not even constitute a major obstruction to visitors. Public hygiene may be a concern, but it does not appear to worry tourists overmuch, who are flocking to see the camp – and boosting local businesses, even as they find the cathedral doors locked. The protesters have a valid point to make; it is not incompatible with tourism.It also has to be asked whether it was wise for St Paul's to complain about the financial losses it was sustaining from the closure. Of course, the upkeep of such a major architectural monument is expensive. But many will feel that there is a distinction between a house of worship and a money-making enterprise and that, where substantial entrance fees are imposed, this line risks being crossed. It is not only the protesters who might be tempted to object: "Ye cannot serve God and mammon."

Only Canon Fraser, the guy who welcomed the protesters, told the police to butt out, and is now threatening to resign, emerges from the affair with credit.

A resolution

I faithfully promise that I will never again use any of the following metaphors:

1. taking a haircut;There you are. Happy now?

2. kicking the can down the road; and

3. using a big bazooka.

More can-kicking

I might have some sympathy with this Guardian editorial:

So the true test of this Brussels summit and the inevitable next one, as well as the G20 in November, is not, perhaps, whether they free Europe from its troubles in one mighty bound. It is, rather, whether the measures emerging from all this tortuous process can sufficiently minimise and contain the impact of the explosion of over-accumulated debt on economic activity and growth across Europe. That's why yesterday's latest effort to Europeanise the Greek debt write-off matters. It's why the Europeanisation of bank recapitalisation matters. And, most important of all, it is why the strengthening of the EFSF bailout fund matters so much too. The test of the summit is whether it enables Europe to take the punishment and remain standing. Muddling through may not seem much of an achievement. But, if it works, it is a lot better than a heroic disaster.Well, yes but ... What if there is a tsunami on the way? Is it not time to erect a powerful sea-wall, rather than simply moving a few metres up the beach and hoping that the tidal wave will die down a bit?

26 October 2011

The Summit, somewhat

OK, it's started. But don't get too excited. I've been to these EU gatherings (not a summit of course, but they don't differ radically from those at a lower level).

Remember, there are 27 participants (not counting the IMF, the Commission and various odds and sods). These are heads of government and they will each want their say. Allow 10 minutes for each and you have already absorbed more than four hours. Then there's dinner to get through, say another two hours. And, then, assuming something has been agreed upon (fat chance!), the non-euro states depart and the Eurozone states go into conclave. Of course, it is now after midnight, by which time the leading participants are thoroughly pissed off at the failure to make progress.

Do you still wonder why they are incapable of doing more than kicking the can down the road?

Remember, there are 27 participants (not counting the IMF, the Commission and various odds and sods). These are heads of government and they will each want their say. Allow 10 minutes for each and you have already absorbed more than four hours. Then there's dinner to get through, say another two hours. And, then, assuming something has been agreed upon (fat chance!), the non-euro states depart and the Eurozone states go into conclave. Of course, it is now after midnight, by which time the leading participants are thoroughly pissed off at the failure to make progress.

Do you still wonder why they are incapable of doing more than kicking the can down the road?

25 October 2011

Kicking the can down the road

The cancellation of Wednesday's EcoFin meetings means that the Euro-summit tomorrow evening is doomed to reach nothing more than agreement on a vague outline framework of the kind of package needed. No member state will be committed to anything and further meetings will be necessary to thrash out the details. And that's the optimum outcome; it could be much worse. The Germans (and the Finns and the Dutch) won't subsidise the Club Med unless they sign up to austerity squared, while the latter will firmly resist being sent down the black hole where Greece finds itself.

The effect on the markets will not be a happy one.

The effect on the markets will not be a happy one.

24 October 2011

For me, it's a puzzler

Maybe I'm a bit dim; or am I being obtuse? The Guardian reports:

Now let us suppose that, on the first question, the Scottish electorate votes 51% to 49% in favour of independence and that, on the second question, votes 70% to 30% in favour of devo-max. What then has been proved? Should independence be abandoned on the basis that it commands less support than devo-max?

And it is no use comparing it with 1997. Then the choice was between devolution or devolution with tax-raising powers - it would have been inconceivable to have failed to obtain a majority in the first question but to have succeeded in obtaining a majority in the second.

Salmond confirmed on Saturday, in his keynote speech to the SNP conference in Inverness, that the referendum, planned for the second half of the five-year Scottish parliament, will consist of two questions.

On Sunday he gave more details. The first question would be "a straight yes-no question [on] independence," the SNP leader said. Alongside this would be "a second question, in the same way as we did in 1997, in which we'd offer a fiscal autonomy option". He added: "I'm not for limiting the choices of the Scottish people, I leave that to Westminster."

Now let us suppose that, on the first question, the Scottish electorate votes 51% to 49% in favour of independence and that, on the second question, votes 70% to 30% in favour of devo-max. What then has been proved? Should independence be abandoned on the basis that it commands less support than devo-max?

And it is no use comparing it with 1997. Then the choice was between devolution or devolution with tax-raising powers - it would have been inconceivable to have failed to obtain a majority in the first question but to have succeeded in obtaining a majority in the second.

Subscribe to:

Posts (Atom)